Ann Pettifor was one of the economists who publicly predicted the crisis in 2006 and as such, is one of the few economists worth paying attention to, despite the fact that the front pages and headlines of the current economic news, to a large extent, continue to emphasize the neoliberal and austerity recipes of those who, at that time, said that everything was going great.

In this book, this prominent South African macroeconomist based in the United Kingdom projects an optimistic viewpoint, in which we perceive the conviction that the mess we are in does have a remedy, and a dose of healthy impatience with those who do not understand anything, a large part of which are economists. It explains the functioning of the current monetary and financial system, in a simplified and understandable way, why it failed in 2008, why none of the solutions that the central banks are implementing will work and finally, it also sets out their vision of how we could arrange the economic system to function in the interests of the majority and in an environmentally sustainable way.

The recipe is simple and clear, in a phrase, "relocalise globalised capital" which "would mean a new world monetary order". Pettifor reminds us that there are innumerable works that present the lack of correlation between the freedom of capital movements and a positive evolution of the economic system and society in the countries in which it has been implemented, and presents a series of points of reform of the monetary and financial system. She proposes that two unusual groups be the champions of this struggle: women and ecologists. And as a strategy, it proposes three things: education, education and education: nothing will change until people understand how money is created much better and how the monetary and financial system works, since the reform of the monetary system is fundamentally a political reform, society has to organize itself to lead political programmes and choose at the polls.

High interest rates for speculation

Ann Pettifor's has a profound understanding of Keynes, and she knows how to present the contributions of this great economist in monetary matters, probably the most significant and influential part of their work and also the most eclipsed in university programmes today. It thus rescues the proposal to regulate credit activity with interest rates on retail credit that are low for productive activities and high for speculation: a type of financial regulation that has proven its effectiveness on countless occasions after the Second World War (we only have to read Richard Werner's work on Japan), although far away from the one that has been implemented after the crisis, based on minimum capital requirements in the banks that will be totally ineffective in avoiding future crises.

Nothing will change until people understand how money is created much better and how the monetary and financial system works, since the reform of the monetary system is fundamentally a political reform

There are three points of her argument with which I fully agree:

- The idea of "promoting an alliance between industry and labour to achieve effective control of finances", that is, workers and productive enterprises unite against financial capital, something that Marxism will have difficulty in understanding, but which genuinely responds to the interests of 99% of the total population.

- The call to ecologists to embrace the banner of monetary reform. In the words of the author: "By not understanding how" easy money "finances" easy consumption" and, consequently, it increases toxic emissions, and the eco-warriors shoot off in the wrong direction."

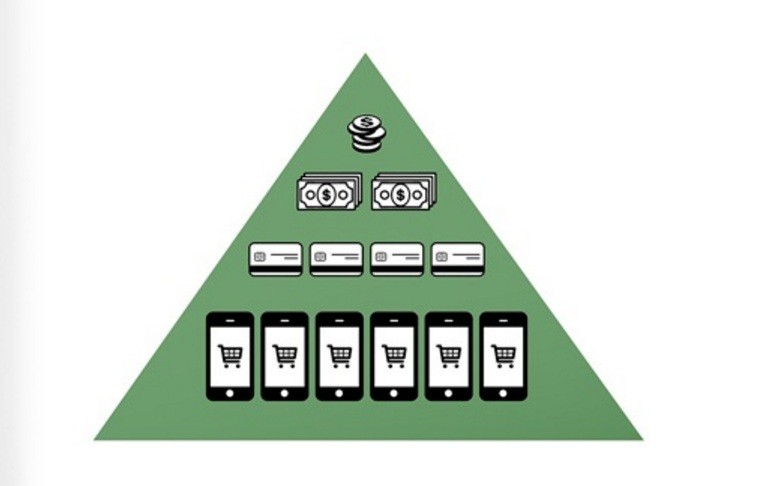

- The creation of money in the modern economy is a great invention that is being misused, but nevertheless a great invention, which should in no way be suppressed. The alchemy of money of which quite few are aware, the possibility of creating money by lending it, one of the most habitual forms of creating money today, management of which bestows immense power, and should be managed in a socially responsible way to benefit society as a whole, rather than systemic a few banks. And in this sense Ann Pettifor takes a stand against other monetary reformers who argue that The creation of money should be exercised only by a committee of experts from the government and proposes to retain the only element of democratic control on money development in existence today: the fact that most of it is the result of people's demand for credit. Ann Pettifor proposes to reform the conditions of access to credit according to its purpose, facilitating it and restricting it to productive and socially responsible activity and making it more expensive for speculation and socially inconvenient investments. This is incompatible with the "narrow money" vision of some monetary reformers, that is, to let the banks lend money however they want, but forcing them to maintain a 100% reserve, that is to say, avoiding them creating money, which without doubt leads to increased interest rates for the financing of all types of economic activity, as has happened throughout history. The fact that we would first have to save to be able to invest, from a social and macroeconomic point of view, is something that we got over long ago thanks to Keynes. We agree that we should not invent money to create speculative bubbles, but if idle resources exist, and the investment is sustainable and adequate, money can and should be created to undertake it. This is a prerogative that we should not give up.

Finances and their henchmen in the media, universities and the establishment will resist, because there is nothing that they fear more than monetary reform

The new economic model

We could argue about some issues related to the production of money, particularly those that are not brought up in the book. The author shows an evident concern for environmental sustainability, but avoids positioning herself categorically with regards to economic growth; demonstrates a moderately favourable view of the Green New Deal on the basis of quantitative easing, such as the Green Money proposal of the European Green Party and accuses neoliberalism of having turned economic growth into its flagship, when what Keynes defended with their policies was full employment. However, we should not forget that Keynesian policies, whenever they worked well, were always accompanied by strong economic growth.

The same Keynes, who pursued the idea of full employment in the 1930s, foresaw that the grandchildren of that generation would live in a quite different world. We are already the grandchildren of Keynes, for whom this thinker augured a substantial reduction of working hours. There is a need for a new economic model for this present time, a new model that Keynes did not have to formulate, because it did not respond to the needs of their time, but whose future existence he was able to predict. It is all very well to start from Ann Pettifor's proposals that preserve elements of Keynes's proposals for the world of 1930 that still have value today, but this can only be the starting point for something more, towards a new economic model, whose cornerstone will remain the monetary system.

This book is short, concise, understandable and is also quite a good starting point for the essential debate of our time: monetary reform. Something that will take all our society's energy to do, because, in the author's own words: "finances and their henchmen in the media, universities and the establishment will resist, because there is nothing that they fear more than monetary reform".

Previously published in http://soberaniafinanciera.org.