A ghost looms over the markets: the ghost of the third recession. since January, the IBEX35 has lost 17% of its value, accompanying the collapse of most European Stock Markets. The risk premium widened again, and doubts about the solvency of several financial systems have returned, including in packages to formerly prestigious banks such as Deustche Bank or Societé Generale. The turbulence in Chinese markets has caused the international financial system to get hiccups, and Europe looks with concern at the slowdown of economic growth indicators for 2017. Are we on the verge of a new crisis?

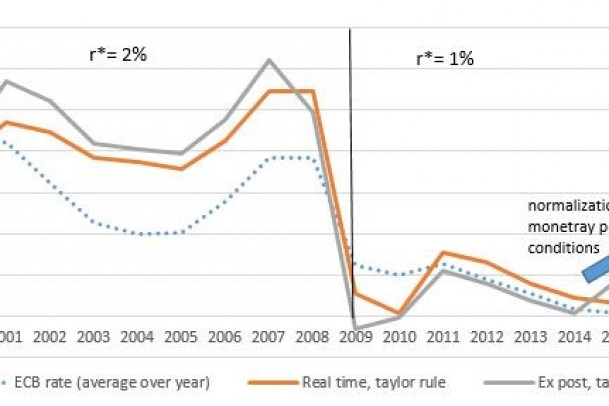

Not really. We are not on the verge of a third crisis because we are still within the systemic crisis of 2007-08. What we are experiencing is nothing more than a new warning signal of the financial earthquake that has been plaguing the international economy for a whopping nine years now. Our only means of knowing when we are "out" of a recession is an official "ex post" review, there are no indicators similar to what tells us we are "in" a recession (traditionally it is considered a recession when there are two consecutive quarters of negative growth, although there are other indicators that are taken into account, such as employment or investment).

So, given that there is no official way to certify when we are "out" of a crisis, there is no clear date of exit from the crisis of 1973, or that of 1929. The sense of crisis is often diluted in our imagination by the years that have passed by the end of a crisis. But what the crisis provokes is what some economists such as Nouriel Roubini calls the "new normal". This is to say, a change in the foundations on which the development of the economy and the markets is based.

This transition to a new normal has so far had three phases: the financial and economic collapse of 2007-2008, with the collapse of markets due to the systemic failure of credit derivatives and shadow banking, the crisis caused by the introduction of austerity policies and their pernicious effects on the productive and long-term growth capacities of the European economy, and now we are facing a new warning signal, located in emerging markets, with its own characteristics and conditions.

SOVEREIGN WEALTH FUNDS HAVE BEEN FORCED TO SELL

In fact, from 2009 to 2014, financial markets used a good part of the emerging markets as a safe haven where they could hide their funds from the turmoil. This meant an significant inflow of capital in these countries, which re-launched its growth, coupled with the price of raw materials. However, 2015 was the first year since 1988 in which emerging markets experienced net capital outflows to developed countries, a trend that has accelerated in the first quarter of 2016. Improved economic conditions in the United States and Europe's coming out of the recession have made the "fearful" capitals return to traditional markets, causing much damage in the financial conditions of the emerging countries.

In addition to this net capital outflow, the fall in raw material prices, the main source of tax revenue for many of these countries -particularly oil- and the effects of a certain Chinese slowdown due to internal adjustments -to a more service-based economy and less in low-cost export industries- that have also swept up the countries exporting to the Asian giant. In 2015, the Chinese industrial sector grew by 1.5%, while the services sector grew by 11%.

Worsening fiscal conditions in some troubled emerging countries have led some sovereign wealth funds -publicly owned funds where the state invests the proceeds of their sales of oil or other commodities- have been forced to sell securities to provide liquidity in their countries. Many of these funds had their money invested in European and North American securities, and this has had a negative impact on the trend in these markets.

THE EUROPEAN FINANCIAL SYSTEM IS QUITE WEAK

This situation described would be nothing more than a little chill in the international economy were it not for the weak state which it finds itself in. The turbulence of the past few weeks acted as an "opportunistic" virus in the debilitated body of a chronically ill, which is the international economy. The exit of the crisis and the ineffective response obtained between 2010 and 2015 from the authorities has left the world economy weak, with low growth and with stark unresolved vulnerabilities.

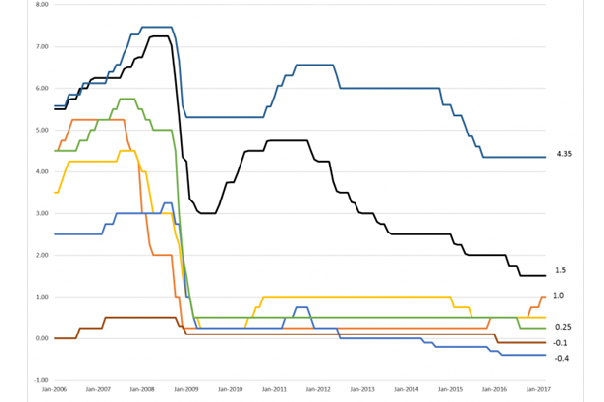

We continue to have a quite weak global demand (IMF dixit), a global debt volume that gets greatly amplified by any economic disruption, there has not been adequate management of the risks inherent in a financial market that remains largely unregulated, and the ideology of austerity, the key that opens fiscal policy, has been thrown overboard just when the extra-permissive monetary policy shows signs of exhaustion of its effects, reaching negative interest rates.

This situation has caused the European financial system to be quite weak. It still carries a large debt burden, and faces quite low interest rates that limits its returns, in a context in which lending remains difficult -not so much because there is no liquidity, but rather because there are no investors- and have to improve their solvency conditions. The suspicion of toxic assets in their balance sheets does not invite us to trust their solidity, and the efforts made by the European banking union are of such a limited scope that we could almost forget about them.

Structural conditions are not in much better shape. The ageing of the population and stagnation in productivity growth, in a context of quite weak demand, as pointed out by the International Monetary Fund, lead us to what Larry Summers, never suspected of being "dovish" (the term which in English refers to those who are less enthusiastic about austerity) is described as secular stagnation, This means a long period of weak and vulnerable growth. Its solution is to carry out a focused stimulus that in the short term allows aggregate demand to increase and in the long term, strengthens the conditions for improving productivity, investing in sectors such as R&D, infrastructure and training.

THE BUZZWORD AMONG ADJUSMENT SHAMANS IN "OVERCAPACITY"

Managers of the international economy, when they met in the G20 event in 2008, proposed to reform the international financial system, with little result. In 2012 they proposed to promote a global macroeconomic rebalancing, tracking the countries with the greatest imbalances, with a zero result, and in 2014 launched their ideas to promote growth strategies, without any effect. In fact, the G20 agenda is correct: redesigning the financial system, rebalancing international economic relations, and fostering growth.

But beyond their pronouncements, little or nothing has been done. With the monetary policy levers practically depleted, and with the key to a fiscal policy of growth at the bottom of the ocean, it is quite likely that Summers' omens will come true.

To deal adequately with this situation, the first thing we have to do is resist the siren songs of different shamans who insist on adjustment as a way out of the crisis. Among these adjustment shamans, the buzzword now is "overcapacity". This is, that the global productive system has more production capacity than what it sells. This is nothing but another way of mentioning (without actually doing so) the weakness of global demand, because with all countries are intent on selling rather than buying, the result could not be more catastrophic. To sell, someone else has to buy. What happens to the global economy is that its demand is quite weak.

It is therefore necessary to recover coordinated stimuli to increase demand and revive the international economy. If the global economy works as a whole, and as long as we do not have commercial relations with Mars, we should look more closely at Keynes's recommendations than at Hayek's.