Conservative thought has always questioned (and continues to do so) that economic crises are inherent in capitalism. However, the stubborn facts, demonstrate the opposite.

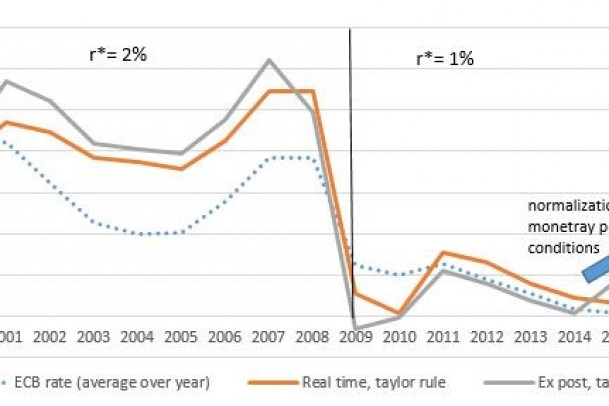

"Marx concluded that the enormous power inherent in the factory system and its dependence on markets necessarily leads to an increase in production that saturates them, lowering prices and causing production to be halted. In a repetition of periods of moderate activity, prosperity, overproduction, crisis and stagnation. For Marx, the very last cause of crises, rather is always poverty restricting the consumption of the masses". This is the way that Wikipedia so clearly explains the mechanism of cyclical crises.

The cycle of about 8 to 22 is known as Juglar cycle, after the French physician Clement Juglar who proposed it. Subsequently, it has been found that these "average" cycles are fractions of longer cycles, from 40 to 50 years, also known as "long waves", that have an expansion phase in which the booms are stronger and prolonged, and one of descent with severe crises and prolonged depressions. In addition, oscillations of forty months or short cycles, called the Kitchin cycle after its discoverer.

At what point in the cycle are we now? Don't know, no answer. The autistic system can only continue to slide down the slope, asking itself, for example, if the last crisis continues, or if we are entering a new one without leaving the previous one, or if the crisis, in short, is ceasing to be short-term to become something structural, in a super-crisis with ups and downs, which only confirms capitalism's death throes. Liberalism responds to no avail: capitalism, like spring flowers, after dying in each crisis, are reborn and renewed, stronger than before.

THE US ECONOMY IS LOSING COMPETENCES

Some crises have been of regional scope and others more extensive and even global. According to C. Kindleberger, from 1615 (the "Tulip crisis" in the Netherlands) to the dot-com crisis in 2000, in almost 400 years, there have been 40 major crises, one every 10 years, on average. Perhaps the next crisis, if we can call it this, will not be the last in capitalism.

However, this does not imply that the countries leading the global economy will not decline with them, as happened before in the UK, cradle of capitalism. And from what we are seeing in Europe and the USA. That's what this is about.

In this sense, Sención Villalona (2010) explains that "the United States' economy is losing competitiveness on a global scale and has increasingly frequent overproduction crises. It is declining in GDP and world trade, its currency is tending to be displaced by other strong currencies, markets are closing and it lacks strategic raw materials, whose exhaustion is accelerated by the growth of other economies and by the accumulation of capital itself worldwide".

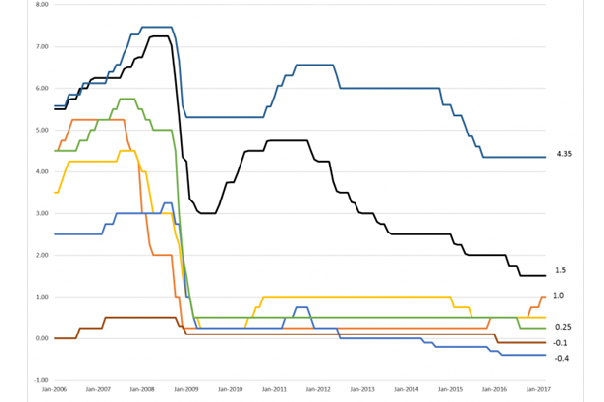

"In the reasoning of Greenspan and other neoliberal theorists, financial and stock markets are supposed to play the role of absorbing and redistributing among their investors the ups and downs of the economy, which should accomplish self-regulation and overall stability of the system.

However, the evidence from recent decades shows that, on the contrary, capitalism's tendency to crises is so strong that no mechanism is able to contain it indefinitely", says Fernando Arribas García, Director of the Institute of Political and Social Studies Bolívar- Marx".

"In any case, as far as the west is concerned, the world will not go back to what it was before the 2008 crisis but, because of its enormous economic and military weight and the tradition of having ruled the world for more than two centuries, the necessary change will continue for years towards a new global economic structure of common benefits between grown and developing countries and a new peace-policy, based not on arms balance, but rather on trust between nations and disarmament", says Javier Colomo Ugarte, Doctor of Geography and History.