The year 2016 had hardly begun and the losses in different stock markets around the world care were already colossal: nearly 8 trillion US dollars during the first three weeks of January according to the calculations of the Bank of America Merrill Lynch. Investment banks became addicts of the Government of the United States' cheap credit policies. And now that the Federal Reserve's System ended their monetary stimuli, the whole world was paying the consequences. In the most recent Davos summit, we noted that there was much uncertainty among big business: no-one knows when the next crisis might explode.

A financial tremor left the Davos club immersed in pessimism. Over 2,000 businessmen and political leaders met in Switzerland (from January 20 to 23rd) and did not really know how to convince the world's people that the economy was under control.

A few days after the XLVI edition of the World Economic Forum, the investors panicked: over the first three weeks of January different stock markets lost 7.8 trillion US dollars, according to the estimates of the Bank of America Merrill Lynch.

For the US investment bank, that month of January will be remembered as the most dramatic moment for finances since the Great Depression of 1929. International financial circuits were increasingly vulnerable.

Price Waterhouse Coopers (PwC) recently published the results of a survey that compiled the opinions of 1,409 CEOs of 83 countries on the economic panorama: 66% of those interviewed considered that their corporate organisations face greater threats today than three years ago, and only 27% thought that global growth will improve.

CAMPAIGN AGAINST CHINA

The uncertainty was such that during the Davos summit, there was no consensus among business giants as to when the next crisis would hit. With this, the western press did not hesitate to point out that the deceleration of China was the principal trigger of the turbulence in the world economy. In fact, the speculator George Soros (who hit the pound sterling in the 1990 decade) maintained in Davos that a crash landing of the Chinese economy was “inevitable”.

Without doubt an exaggerated affirmation. In my judgement there was a propaganda campaign against Beijing that attempted to hide the serious economic and social contradictions that persist in the industrialized countries (the United States, Germany, France, the United Kingdom, Japan, and so on).

In spite of the triumphalism of the President of the Federal Reserve System (FED), Janet Yellen, about that time the United States’ economy began to present signs of weakness. The manufacturing sector had accumulated two months of contraction in December: the lowest level in the last six years.

At the same time, the fall of commodity prices had resulted in an appreciation of the dollar and with this, it became more complicated for the North American Government to bury the danger of deflation. The horizon now was more sombre since the international valuation of crude oil has fallen below 30 US dollars per barrel. Worde still, the International Monetary Fund (IMF) reduced the new account of its perspectives of growth of the global Gross Domestic Product (GDP) for this year from 3.6 to 3.4%.

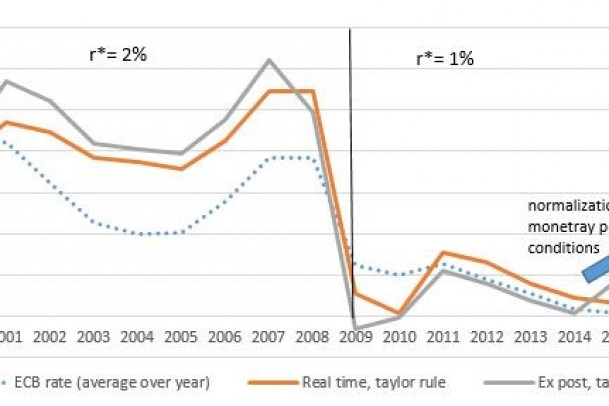

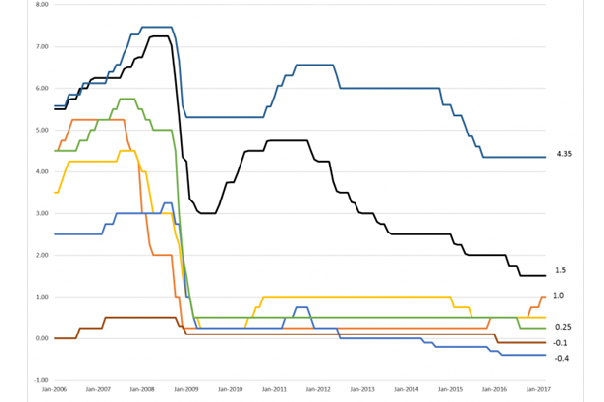

The truth was that the policies of cheap credit fostered by the central banks of the industrialized countries after the bankruptcy of Lehman Brothers provoked enormous distortions in the credit market and now the world was paying for it. According to the calculations of the investment fund Elliot Management (directed by Paul Singer), the great power's central banks had injected approximately 15 trillion US dollars since the crisis of 2008 through the purchase of sovereign debt bonds and mortgaged assets.

Sadly, this strategy did not establish the bases of a stable recovery, rather on the contrary increased financial fragility.

The Eurozone has not been able to get out of low rates of economic growth. The crisis did not only strike countries such as Spain and Greece, the core of Europe has encountered severe difficulties: deflation now threatens Germany, after indicating that the consumer prices rose only 0.3% on average in 2015, the lowest since the recession of 2009, when the German GDP fell 5%; and the then President of France, François Hollande, announced a “state of economic emergency” in the face of high unemployment and the debility of investment.

EEUU PLAYS AN IMPORTANT ROLE IN MONETARY POLITICS

This had left the President of the European Central Bank (ECB) Mario Draghi quite worried, and he was obliged to consider the extension of measures of stimulation for the month of March. The same thing has happened in the Bank of England and the Bank of Japan: in spite of having situated the interest rate at a minimum level and launched aggressive programmes of injection of liquidity.

They still have not managed to bring their respective economies out of the predicament nor increase in any substantive way their inflation, that was still a long way from the official objective of 2%.

With all this, the overwhelming domination of the dollar in the global capital market attributed to the United States a decisive role in the determination of the monetary policy of other countries. There was no doubt that the FED was mistaken in raising the federal funds rate in last December. Simply there were no sufficient elements that allowed the conclusion that the recovery of the US economy was solid and sustained.

Now that the situation has become worse, it was almost that in its proximate meetings the Federal Open Market Committee (FOMC) of the FED would not only increase the cost of credit, but may well reduce the reference interest rate.

Nevertheless, the great problem was that no-one seriously knew how the financial markets would react to even a rather slight movement of the FED. Will the successive Wall Street precipitate a world recession? Would the hegemony of the dollar be fatally wounded by the massive sales of US Treasury bonds?

To what point would China and the emerging countries resist? The impending crisis was an enigma for all….