The contradictory messages emitted by the central banks could be a disguised signal of their intention to end their quantitative easing programmes.

In recent years, central banks have managed to prevent markets from worrying about guessing the direction of their policies by giving them indications that have not been too dramatic or overly inaccurate. However, recent swings in monetary policy statements suggest that central banks are calling the markets' attention to prepare for the end of monetary easing in Europe, according to Daalder.

It alludes to a famous quotation from former US Federal Reserve Chairman Alan Greenspan: "Since working in a central bank, I have learned to mumble with great incoherence. If you think I'm too clear, you probably misunderstood what I said”.

THE END OF THE QE IS ON THE WAY!

"This shows that central bank communications are not always straightforward," says Daalder. "When we are 'too clear', as Greenspan says, our words may turn against us if, for example, the economy takes an unexpected turn. On the other hand, if we are too imprecise, we can create confusion in the markets about what to expect.

So it is best to be in the middle: leave the different options open, never be too explicit, and try to subtly insinuate to the markets which is the right direction”.

"This strategy has been successfully implemented: the days when monetary policy developments are announced are now quite boring. The fact that the Fed has been able to carry out three rate hikes in its current cycle and has announced the first measures to reduce its EQ without unduly hitting the equity and fixed markets is clear evidence that communications have been properly managed”.

"With all this in mind, a little surprise happened in the last two weeks on this side of the pond... What are the European central bankers trying to tell us? It seems increasingly likely that they are aiming for the end of quantitative easing".

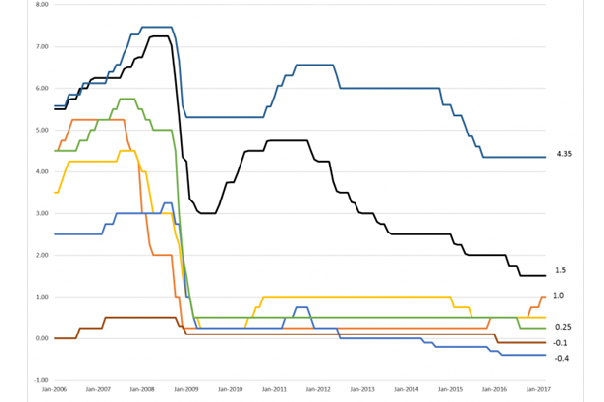

THE BANK OF ENGLAND

Daalder argues that a good example of these insinuations that could herald a monetary tightening is the Bank of England's (BoE) attitude, which is usually quite subdued. On June 15th, the Chief Economist of the BoE, Andrew Haldane, was one of five members of the Monetary Policy Committee who voted to maintain rates at 0.25%. However, a full week later, it turned out that it would be prudent to partially reduce the stimulus measures. The Governor of BoE, Mark Carney, who had also endorsed the maintenance of the rates, echoed the same message on June 28th.

"What could be the reason for this change of heart?" Daalder asks. "The fact that central bankers change their minds is not in itself an extraordinary or negative event. Following the unexpected outcome of the referendum on Brexit in 2016, the BoE announced additional monetary stimulus measures to soften the predicted blow to the UK economy. This blow did not occur, and the economy continued to expand, which 'per se' would be a valid reason to withdraw some of that additional stimulus."

"However, it is difficult to determine the cause of the change in BoE's attitude, particularly now that growth forecasts have worsened, as consumers are caught between price rises and falling real incomes, and given the traditionally relaxed attitude of the BoE to the 'temporary' inflation rallies. So if the BoE is now serious about the issue and wants the market to prepare for a future interest rate hike, we would expect more signs of this kind (as well as an improvement in economic data) in the next month".

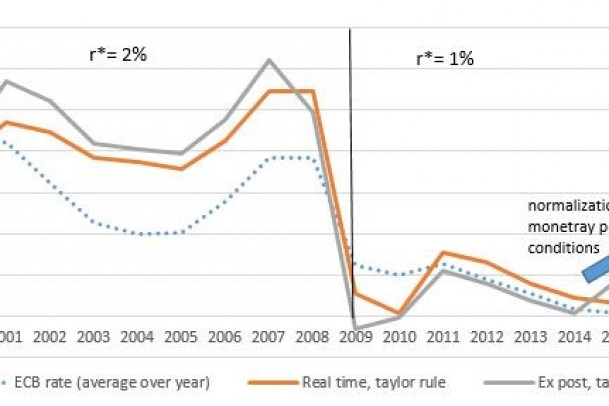

LET'S LOOK AT THE ECB

Then, we come to the European Central Bank (ECB), which faces a rather different situation but whose president, Mario Draghi, has also emitted contradictory insinuations along these lines. "The ECB is also sending disparate signals lately," says Daalder.

"At its June meeting, Draghi surprised the market by reducing the inflation forecast to 1.3% by 2018, citing the absence of real inflationary pressures, as the improvement in labour markets has not translated into an increase in wages. Even by 2019, the ECB forecasts an average inflation of just 1.6%, a rate that is technically below its own target. The underlying message is: we are in no hurry to change anything in our current mix of monetary policy".

"But then came Draghi's discourse on June 28th, in which he said that 'deflationary forces have been replaced by other reflationary ones', words that caused a major commotion in the market, and which raised both the Euro and public debt interests. Has Draghi been 'too clear' leading the ECB to try to convince the market that they have misinterpreted it?”

EFECTS ON MARKETS

"Where does all this lead us? Despite these somewhat confused swings, reading between the lines we can deduce that the end of the quantitative easing in Europe is approaching. It is interesting that the Central Bank, which has indicated that this is the directs the most. The BoE is the one with the least credibility, while the one that has detracted from this possibility (the ECB) has the most arguments to make it happen. No radical action is expected, but an intensification of these insinuations is likely in the coming months".

Daalder believes that the net effect of such a measure on financial markets would be that interest rates on European bonds would continue to rise and consequently their prices would continue to decline. "We remain under-weighted in public debt, so this recent evolution does not worry us too much," explains Daalder.

"Stock markets have been favoured by low interest rates on fixed income and low spreads, although the prospect that central banks may reduce their interference may have a negative effect on market sentiment. Given that we do not expect any sudden or unexpected changes in monetary policy, we maintain our neutral position in equities”.

QE: Quantitative Easing. Is a public economy measure consisting of printing money and putting it into circulation. It is used by some central banks to increase the money supply, increasing the excess reserves of the banking system, and generally by buying bonds from the central government itself to stabilise or increase their prices and with them reduce long-term interest rates. This measure applies when the most common methods of controlling the money supply have not worked.