The future of capitalism and the free market society will be settled in relation to the future of capital, labour and the fundamental resource of exchange: money. In the process of so-called digitization, we are seeing: first, the disappearance of labour in favour of technological capital (automatic and increasingly autonomous systems); secondly, we are increasingly seeing the disappearance of physical money; and therefore a more abstract means of transaction, the re-definition of capital-money and its social impact.

The immateriality of currency

The regulation of means of payment (PSD2), which will enter into force in 2018, will introduce in Europe the possibility of creating new means and payment services. This legislation clearly favours the consumer, and will produce processes of disintermediation in relation to banks. Therefore we will see that the concept of "payment" will move away from traditional banks, and a greater selection and competitiveness of services will appear. These will be particularly relevant in the relationship with the retail customer, although they represent only 15% of banking entities' income. We suppose that entities will lose control of these media in benefit of "Fin-Techs", distribution chains and other possible agents. A sensor in your mobile phone will be able to pay for the shopping in the supermarket, access to means of transport, in the airport. A sensor in your car can pay for the parking, motorway tolls, but nevertheless be safe and dependable in its behaviour.

This competition will increase with the emergence of technology companies that also offer banking services, such as Facebook, Amazon and Google. In some cases, these have already applied to the EU for a banking licence. Orange's announcement that it will provide banking services in Spain from 2018 goes in this direction. It seems that Apple has decided to disengage itself, and is more interested in collaborating with traditional companies, as seen in the deployment of Apple Pay with its global alliance with IBM, and its agreements with banks.

Redefining capital-money: "digital" markets

Digitization has allowed the emergence of what we call technological or digital markets, that is, where human agents and algorithms interact. These markets in themselves are a quite profound paradox. For a long time, we have assumed that the more the information, the greater the transparency and the greater the capacity to organize companies and markets at lower cost. However, information can also produce contagion effects, and therefore generate the paradox that more information at higher speed can generate disorder.

The competition will be increased by the increasing appearance of technology companies offering banking services, such as Facebook, Amazon and Google

Greater automation in decision-making in the purchase and sale of financial assets, and the algorithmic sophistication of certain high risk investment products such as derivatives, have increased the risk of systemic collapses. Making decisions about which products to buy and what resources to invest in can trigger these contagion effects, allowing either competitive advantages or unpredictable falls. These informational contagion effects have a determining effect on the assessment of systemic risks.

Systemic risks

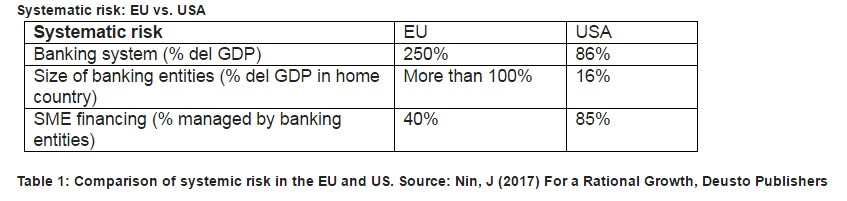

In the Eurozone, capital regulation has attempted to reduce the efficiency of monetary transactions to avoid contagion risks. If the efficiency is lower, more time is available to detect and act on these possible risks. However, the effect has been the concentration of entities and the reduction of competition in favour of a banking oligopoly. As Juan María Nin shows in their book "Towards Rational Growth", the systemic fragility of the Euro area is higher than in the USA. The financial system in the Euro area represents 250% of the real economy. The banking dependence on SME financing is much higher than in the US, and Europe has banks that manage resources of a higher value than the GDP of their countries of origin (see Table 1). In this way, according to the data we have, the tendency towards more control is producing more fragility in the system.

We should understand that it is one thing to comprehend the risk of a banking entity through its capital requirements, but it is quite another to risk the interactions of the new financial ecosystem that will emerge in Europe. Interactions are mediated by multiple technologies; present spatial patterns such as fraud, and temporal patterns such as high frequency transfers will therefore require real-time monitoring. As the European Union claims, the regulation of a digital market, requires an understanding of what a financial market is and what the digital concept means. Markets are not ruled by "invisible hands," but rather by quite visible "agents" such as algorithms, computer applications, "data patterns" and business ecosystems. The economy of high speed data produces economic effects that cannot be regulated with "local" analyzes from time to time.

Social effects

Current "techno-optimism" tends to regard technology in one direction (that of progress) by committing to the belief that such progress has no negative effects on the economy (employment, wages and pensions), social structure or even the environment. Lewis Carroll stated in Alice in Wonderland that to stay in a place you have to run, a metaphor about the accelerated change of progress. Progress that progresses in the form of "revolutions". The German philosopher Walter Benjamin affirmed that revolutions are not changes in the rate of progress, but rather the opposite: brakes that society tries to put on dogmatic progress, one without discussion or criticism, that blindly destroys everything in its wake, that is to say, our social structure.

I believe that the future of money and its impact on capital markets, systemic risks and social impact should be high on the political agenda

History shows that shortage of employment in a quite a powerful mechanism in the political agenda. If digitization leads to higher levels of automation and the exponential increase of information puts social structure at risk; and these effects are reinforced at the same rate as the depletion of human resources, natural assets and energy sources, then the risk of collapse is evident. For this reason, it could be that we are in the prelude to a revolution, in Benjamin's conception, derived from the lack of faith in the system. In the last financial crisis, Spain lost 10% of its wealth (GDP). The recovery has taken 10 years. This is not only the 100,000 million Euros, but also the social conflict caused, and we are still far from being recovered at institutional level. After the crisis, the savings bank network has disappeared, and the concentration of banking institutions has consolidated. Will the economy's dependence on a few banking giants make the system more robust? I think we should focus on the development of new capabilities, new technological functions and innovation in services.

Conclusions

I believe that the future of money and its impact on capital markets, systemic risk and social impact should be high on the political agenda. Regulation and taxation need to better understand systemic effects in this digital age. Regulating individual agents in a system is simpler than regulating the system as a whole. I also believe we should back training and education. We have to learn to use money technology to propose solutions for employment, income distribution, financial systems, access to basic services and balanced management of planetary resources. Developing a path of discovery to understand possible future scenarios, understanding systemic risks, defining projects and providing solutions is the most relevant challenges of our time.