Economists and politicians are always worried about the next crisis, the next recession. It is not difficult to understand why, as the world has seen many of them. In my book “Escape from the Central Bank Trap”, I explained that the indiscriminate creation of money without support is behind every great crisis. And the following one will not be different.

Politicians and governments have created an enormous body of regulation and legislation to supposedly safeguard economies from the risks of the previous crises. But the next one will not come from housing, or technology bubbles, not even from energy prices. It will come, as all crises do, from the assets that we consider safest.

Risk accumulation does not happen by coincidence or recklessness. Financial crises erupt always from an accumulation in assets in which the public perceives that risk is very low. And in today’s world, the two asset classes where financial investors and governments perceive there is no risk are infrastructure and sovereign debt. No amount of regulation and legislation is going to mitigate the governments’ relentless call to accumulate funds in these two assets under the idea that they are safe.

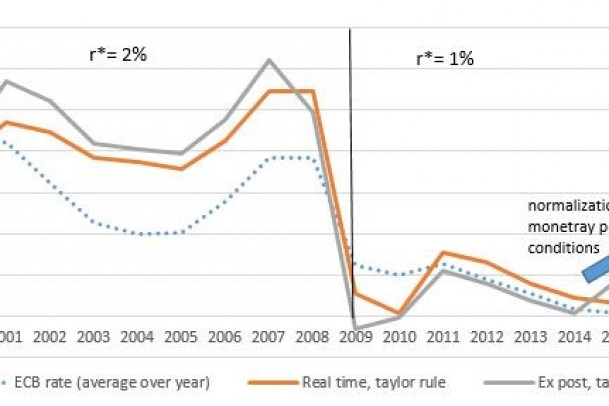

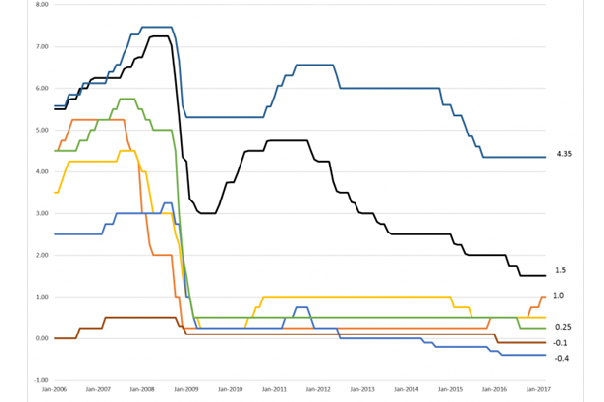

Multiples in infrastructure investments have soared in the past years, coinciding with the longest period of financial repression. While the world saw 600 interest rate cuts, moving to negative real rates in many countries, multiples paid-for infrastructure assets multiplied by five. The search for yield was on.

NEITHER GROWTH NOR INFLATION WAS AS EXPECTED

At the same time, bonds with negative yields surpass the $9 trillion figure, and emerging markets, high risk companies as well as deficit governments are financing themselves at historic lows. However, low rates have not helped deleveraging. Global total debt has soared to 325% of GDP, driven by an extraordinary increase in public debt. At the same time, the ability to repay those debts has not improved, as the Bank of International Settlements and Moody’s, among others, have warned.

The trigger for this accumulation of risk to develop into a worldwide financial problem could be the “sudden stop”. The abrupt decline in capital flows into debt and emerging markets due to a normalization of monetary policy in the US and strengthening of the US dollar.

In the past decade, the world has seen an unprecedented flow of capital into emerging market debt and infrastructure projects incentivised by the abnormal increase in money supply and low rates in the US. This “global carry trade” (take advantage of liquidity and low dollar rates to finance the purchase of better performing assets) made investors use “cheap” dollars to buy “growth” assets.

Expectations of inflation and higher growth inflated the bubble created by excess liquidity and low rates. However, reality started to kick in and neither growth nor inflation are coming as expected. Through cheap debt, the world entered a period of low growth, weak productivity and low inflation. Cheap money created cheap debt, rather than lucrative growth.

WE ARE LIVING IN A PERIOD OF LOW GROWTH DUE TO AN EXCESS OF STIMULUS

In Brazil, this effect was called the “monetary tsunami” by president Rousseff. Yet the country, under her mandate, fell into the trap, spending billions on unproductive projects and increasing imbalances, multiplying debt and creating the root of a large and complex recession.

China, in the past eight years, has multiplied debt and faces similar challenges of overcapacity, weak productivity and capital outflows.

The “sudden stop” does not happen in one go. It happens in stages. We have seen two of the first stages in 2013 and 2015. But the consequences of a larger outflow of capital from emerging markets back into the US have not been adequately analysed. This time, central banks will not have the traditional tools to tackle the crisis, lower rates and increase liquidity.

The world is awash with liquidity and rates are unsustainably low. Neo-Fisherism economists argue that the solution to secular stagnation and the risk of a sudden stop is to raise rates, rather than keeping them unsustainably low. This would drive an acceleration of productive investment, reduce perverse incentives to finance white elephants with cheap money, and trigger an improvement in core inflation as consumption rises.

I would argue that this is only one part of the solution. The other is a fiscal policy that is truly oriented towards growth, lowering taxes, improving disposable income and allowing productive sectors to thrive.

The next recession will likely hit harder than the last one, because there are no demand-side policy tools to disguise imbalances.

To avoid this from happening, governments need to think of real solutions that allow companies to grow, invest more and create better jobs. The failure of government stimulus and deficit spending is evident. It is time to let high productivity sectors thrive.