Donald Trump's recent statements have brought the issue of protectionism fully into the spotlight. We knew that the newly-elected US president encouraged companies to "relocate" their production in US territory. And so the first results obtained, even before taking possession of the Presidency, were indeed encouraging. A number of companies, such as Ford, Chrysler and also General Motors, Samsung and LVMH pronounced their decision to return to producing in the United States. Which leads us to consider two questions. Is this good in the medium and long term? Also, how can companies be forced to "relocate" their production?

Protectionist methods get bad press. It is enough to consider the reaction of Professor Lionel Fontagné, former director of CEPII: "Relocated production will be more expensive than the imported ones. Thus, the jobs gained by these relocations will be compensated for by other job losses, as a result of the loss of household income generated by these additional costs. Except that Fontagné, in his anti-protectionist fury, forgets an essential point: the income of households will be increased by supplementary workers being hiring, who will have a salary instead of getting unemployment benefits. In industry, the average salary level is much higher than unemployment benefits. If Fontagné had wanted to deal honestly with the issue of protectionism, he would have contrasted this loss of purchasing power against the gain from the recovery of employment. This is something that that does not seem difficult. The production of cars in the 1980s was approximately four million units per year in France. Currently, it has dropped to two million. Suppose that by different protectionist measures, 500,000 more vehicles per year are produced, and that these cars are from a medium-low segment, with a price of 10,000 Euros, and that the increase is 10%, which explains why the cars of this type are largely produced abroad. The loss of income is calculated at 500,000 x (10,000 x 0.1) = 500 million Euros.

IS PROTECTIONISM A CONDITION FOR GROWTH?

However, these cars still have to get produced. We will need to build a new assembly plant, employing around 7,000 workers; we will need to increase subcontractors' production; also the consumption of electricity... All-in-all, we can estimate that around 40% of the sale price will be reinjected into the French economy (supposing that around 60% of this is used to pay for imported goods and services). Thus 500,000 x 11,000 (price in France) x 0.4 = 2,200 million Euros. If we subtract 500 million Euros from this amount due to the rise in prices and an adjustment of 2,200 million Euros, it means that we have a net growth of 1,700 million Euros of currency injected into the French economy.

In effect, we can assume that all automobile production will suffer a price increase in France we take protectionist measures.

However, this generalised increase will be less than 10%, due to the fact that the cars produced in France have a part of their components manufactured inside France. On the other hand, if these measures are adopted, it will increase the proportion of components manufactured in France. It is true that the extra cost will be higher than the 500 million initially calculated. However, the profit obtained from the injection of currency in the French economy, linked to the growth of the share of national production, will also increase. All this raises the question of whether protectionism is a pre-condition for growth.

This question may be absurd. After all, is the growth in the last twenty years not attributable precisely to the liberalisation of international trade? It is exactly at this point here where a fundamental error in economic theory lies. The supporters of free trade, sometimes unknowingly, fall back on the old mercantilist theory that makes trade the cause of production. But, in reality, trade is good for whoever produces. Production comes first, and exchange later.

THE OPENING UP OF ECONOMIES DOES NOT PRODUCE BENEFICIAL EFFECTS

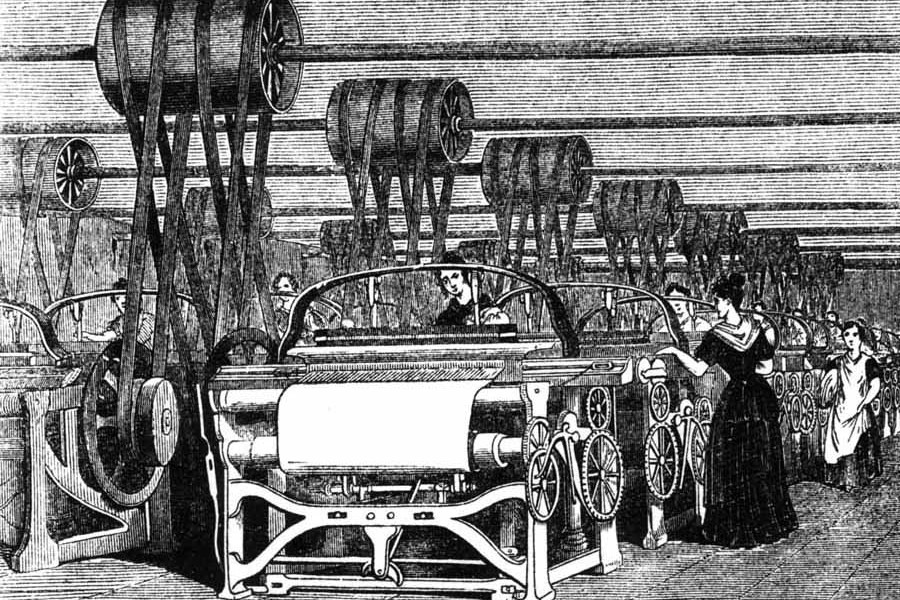

Historically, the great periods of economic growth have coincided with periods of protectionism, as in Europe from 1945 to the 1980s.

In fact, there has been a decline in growth coinciding with the integral opening of the economies.

Reduced growth, yes, but not reduced profits. In reality, free trade allows the profit margins to remain quite high while growth declines. For some commentators it is true that these profits should be transformed into investments. No profits today is a guarantee of more investments tomorrow and more jobs the day after tomorrow. However, this "guarantee" is absolutely illusory. Today's profits might be dissipated in speculative activities, in luxury expenditures, which have no impact on investment and employment. In fact, this justifies protectionist policies, which can be in the form of customs duties, regulatory measures, social or environmental standards, and even by a sharp depreciation of the exchange rate of the local currency.

In reality, the opening up of economies to international competition does not produce beneficial effects unless this concurrence is "fair". This is, if it promotes business projects rather than wage, social or fiscal dumping mechanisms. This is the lesson we can draw from Donald Trump's current policy. Moreover, this is why we should be on our guard. In any case, those politicians who are speaking today about "manufacturing in France", is this not protectionism? It is surprising that a favourable discourse is proposed about "manufacturing in France", while continuing to denounce protectionism. This is something that reveals a deep incoherence of discourse. We have to thank the President of the USA, who, with his decisions has make this inconsistency visible.