Protectionism vs. the free market is quite an old debate, but that even today is still quite topical. Which of the two options is the ideal one in current times? The discussions date from the 17th and 18th centuries. At that time, the idea was that the wealth of a country, that is to say gold, had to be preserved, and that imports implied the exit of gold from the country, so that the aim was to protecting gold reserves while limiting imports.

In Adam Smith's book "The Wealth of Nations", he went a step further by stating that the significant thing is not the wealth of each country, but rather that of all countries, so that a free market would end up giving wealth to all Nations. Modernly, it is this vision that prevails in the main economies.

Milton Friedman also opined in this regard saying that free trade is an incentive for countries to be economically dependent on each other, and that it helps developing countries.

Let's say that the protectionism and free market theories are the opposite poles of reality, two totally opposite economic systems in which the theory of free markets gives absolute freedom to the market, while protectionism implies a clear interference of the State in trade, thus limiting this freedom of action.

Protectionism could be defined as that doctrine or economic branch that is in favour of a country that protects what it produces against the products of other countries that involve competition and for this uses different means such as customs duties and other restrictions to imports.

Thus, it is based on the protection of the economy of a State against the presumed threat that the importation of products and goods from other economies that are direct competition would imply.

To do this, customs fees and other taxes imposed on all products or goods coming from abroad are established, with the clear intention of obtaining a positive balance with commercial transactions at an international level.

NO-ONE SHOULD GET RICH AT THE EXPENSE OF ANYONE ELSE

We could say, as explained by different economists in favour of this trend, that this is based on the fact that no country can and should not be able to enrich itself through the impoverishment of another.

Supporters of protectionism argue a series of positive reasons such as:

Economic independence.

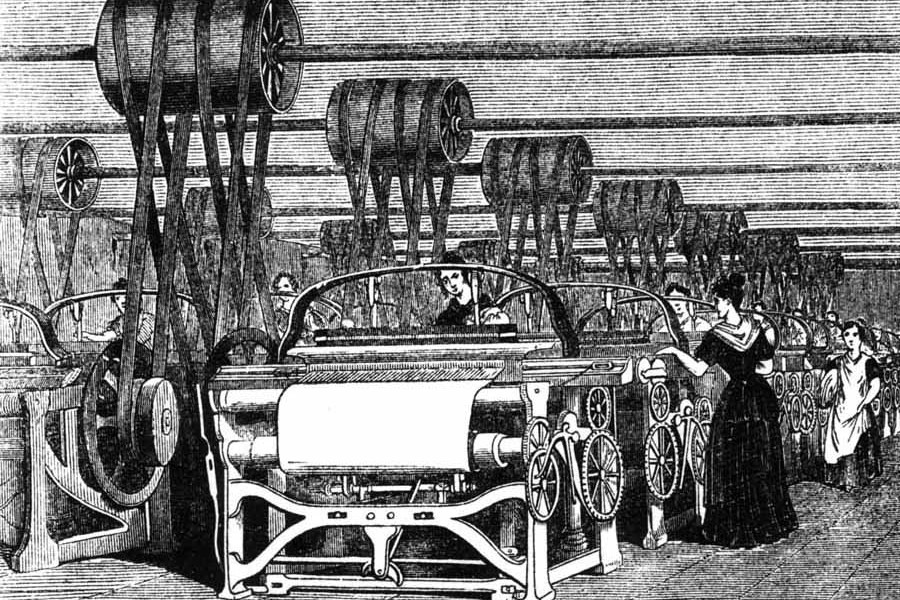

To aspire to achieve a minimum level of industrial development.

Resolve disparities in the balance of payments.

Support an economic development among the different regions of the territory. This is, those in favour of protectionism allude that with free trade the development countries would be harmed and it would be difficult to create their own industry, something that would only be avoided by restricting or limiting foreign competition.

For their part, the detractors point out a series of reasons to be taken into account:

There is a real risk that some goods may not be bought worldwide and that this might cause certain markets to shut down, with the consequent harmful effect for the economy.

Other countries could adopt the same position, with which the free movement of goods and goods would be clearly questioned and compromised.

As I mentioned earlier, the means used by protectionism is duties and tariffs, taxes that are imposed on imports (sometimes even exports to increase tax collection).

There are different kinds of tariffs:

Transit tariffs: taxing goods that enter the country but actually end up going to anothers.

Ad valorem (value-added) tariffs: these tariffs apply a percentage in relation to the value of the goods. For example, 15% means that a 15% tax is applied on the value of the property in question.

Specific tariffs: they are applied taking into account or as a base a unit or quantity of goods. For example, a tariff of 5,000 Euros per metric ton might be applied.

Mixed tariffs: those that contain several elements of those previously explained.

Compound tariffs: these are ad valorem tariffs in which a minimum or a maximum is fixed. They can also be specific tariffs when the ad valorem tariffs do not reach the minimum value or when they exceed a maximum value.

ALL PROTECTIONISM TENDS TO TRIGGER COMMERCIAL WARS

All protectionism tends to trigger commercial wars, mainly because the affected countries do not sit idly by, and retaliate with the same or greater intensity.

And what are the consequences of a commercial war for the financial markets? In principle the stock markets would fall and the dollar would depreciate.

Investors would surely choose to sell the greenback in search of some security and tranquillity in safe haven assets, such as the Japanese yen, the Swiss franc and the Euro itself, without forgetting gold.

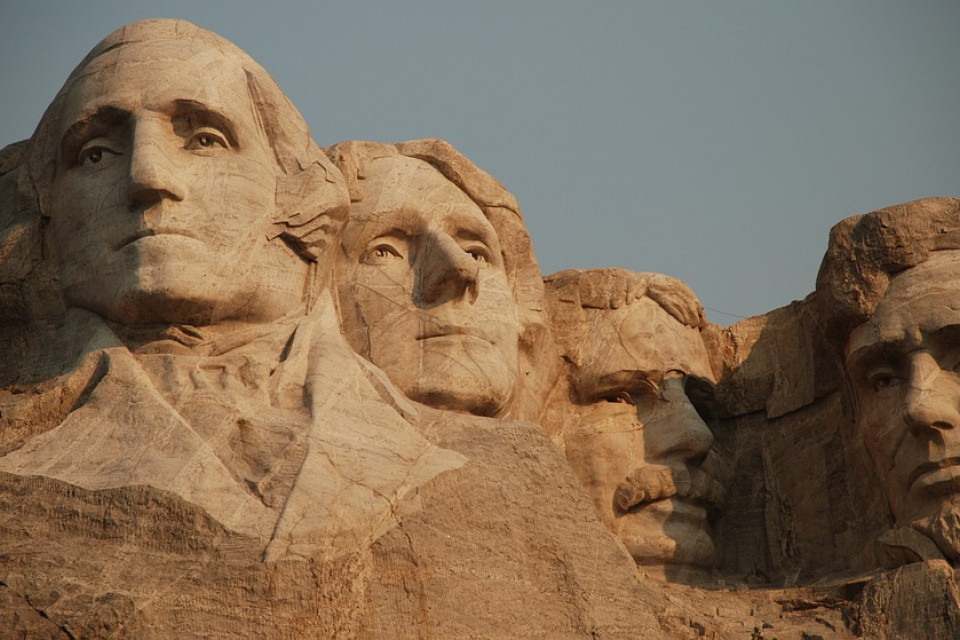

We hope that the United States and China reach an understanding, because in a commercial war, there are no victors. When President Bush raised steel tariffs in March 2002, the country's GDP fell 30.4 million dollars and 200,000 jobs were lost. The European Union threatened to respond with tariffs on Florida oranges and Michigan cars. In December 2003, Bush gave in and reversed his decision, not in 2005, which had been his initial idea. The stock market fell and the dollar was the great loser.

And it could undermine the economic growth of the country, because we should not forget that the Trump initiative to protect US metal producers could increase prices for consumers and for companies. Moreover, we estimate that US growth could be reduced by 0.2 percentage points this year.

Not only is it susceptible to a trade war, but a protectionist policy generates inflation and higher import taxes.

In any case, the confrontation between the USA and China has calmed down. It has not been resolved, but neither has it gone any further. Yes, it is true that China was the first to reach out to Trump, but the Asian giant has more to lose, basically because exports to the United States are a key factor in its economic model. The trade surplus in favour of China would be directly hit by a protectionist escalation between the two largest economies in the world. Potentially, this is why China is much more exposed.