All crises manifest themselves at the weakest point and this is always the financial market, credit and shares, which is more subject to market volatilities. But these are like fever, a symptom of the crisis, but not the cause or if the disease. Asian stock markets are far from reflecting the economic reality. Just six percent of Chinese have shares, compared with 50% of Americans. Asian stock markets excluding Japan, have volumes of business and capitalization that are far below the European and North American markets.

But it is clear that we are facing a deeper crisis in the form of the crisis of the inflexible single-output model that has been generated from the Chinese phenomenon in emerging economies, in Asia, Africa and Latin America. Its growth has been so spectacular since the beginning of this decade compared with the situation in Western economies; their impact is much more global than was the tequila crisis or the Brazil crisis, the so-called samba effect in the nineties.

What are the symptoms of the crisis

The recession started with the long duration of the financial crisis of Western economies. The contraction in demand as a result of the credit crunch; high rates of unemployment and falling real wages since 2008 prevail in the major European and North American economies. China and the emerging Asian economies maintained their high growth rates amid the recession in Western due to increasingly artificial elements. While actual production fell and investment incentives were replaced by stimuli to consumption, a large real estate bubble animated by a lack of regulation and very opaque market conditions took place. The crisis in the Chinese real economy began in 2008, but its symptoms were hidden by the bubble and the expansion of the stock markets in which many Chinese became billionaires through the use of insider information and market dynamics. Again, credit was deviated from the real economy to the purchase of housing and shares, and to meet the demand for liquidity, they came to Western markets, the dollar and the Euro, and now with their currencies are in freefall. This debt will bring with it large-scale bankruptcies of many Chinese, Korean companies and of other Asian tigers.

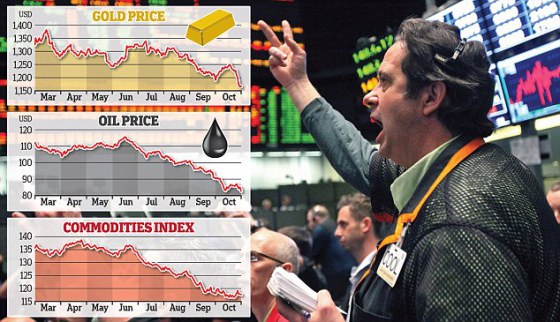

Although the increase in prices of raw materials were based on the growth of demand in China and neighbouring countries, since 2009 it has become clear that the Chinese economy would buy less and less. Today there is an oversupply of raw materials which have led to a fall in prices to disaster levels never before seen.

For producing countries that have based their economy and their growth on the rising prices of raw materials, the blow is brutal. Oil has gone from $130 to $40; soybeans from $620 a tonne to 300. Countries such as Russia, Malaysia, Kazakhstan, Venezuela, Argentina and others have seen reductions in the value of exports of 50% in the last two years. These trade imbalances have triggered devaluation of currencies. The Rouble has risen from 35 to 80 per Euro; The Bolivar, which a year ago still had an official exchange rate of 12 and 40 on the black market, is now trading at 300 to the dollar; the Argentine peso, the Colombian, the Malaysian Ringgit and the Kazakh Tenge, to cite several cases, have fallen in value in recent months by more than 20% and the trend is getting even worse.

All these monoculture-dependent producer countries will experience severe contractions in their economies; Middle East and African producing countries will see contractions over 5% for this year alone, and next, Russia could contract further by to 10% and Argentina and Venezuela's economy will enter into collapse by the end of year. With greater diversification, Brazil and Mexico will better endure the contraction, but the political crisis in Brazil opens up a new front of uncertainty.